Hurricane Deductibles in Florida: What You Need to Know

Florida, with its stunning coastline and tropical climate, is known for its beautiful beaches and sunny weather. However, the state also faces the annual threat of hurricanes. If you own property in Florida, understanding hurricane deductibles is crucial to ensure you're adequately prepared for the potential financial impact of these natural disasters. In this article, we'll explore what hurricane deductibles are and how they work in the Sunshine State.

What Is a Hurricane Deductible?

A hurricane deductible is a specific type of deductible that applies to insurance policies covering property damage caused by hurricanes. It's important to note that hurricane deductibles are typically separate from the standard deductibles that apply to other perils, such as fire or theft, in your insurance policy.

Key Aspects of Hurricane Deductibles:

-

Triggered by Named Storms: Hurricane deductibles are activated when a hurricane has been declared or when a "named storm" is officially identified by meteorological authorities. In Florida, named storms are a common occurrence during the hurricane season, which runs from June 1st to November 30th.

-

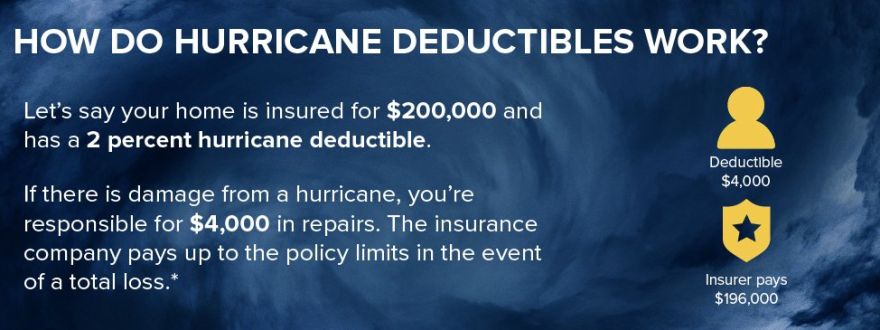

Percentage-Based Deductibles: Unlike standard deductibles, which are often fixed amounts (e.g., $1,000), hurricane deductibles are usually calculated as a percentage of your property's insured value. Common percentages range from 2% to 10%, but they can vary depending on your insurance policy.

-

Higher Out-of-Pocket Costs: The percentage-based hurricane deductible can result in significantly higher out-of-pocket costs for property owners compared to standard deductibles. For example, if your property is insured for $300,000 and you have a 5% hurricane deductible, your deductible for hurricane-related damage would be $15,000.

Why Hurricane Deductibles Matter in Florida:

-

Protecting Against Catastrophic Loss: Hurricane deductibles are designed to help insurers manage the increased risk and potential catastrophic losses associated with hurricanes. They encourage property owners to take measures to reduce risk and prepare for hurricanes.

-

Managing Costs: By applying a percentage-based deductible, insurance companies can mitigate the financial impact of widespread hurricane damage. This helps keep insurance premiums more affordable for policyholders.

-

Risk Assessment: Property owners in Florida must carefully assess their property's value and the potential financial impact of hurricane-related damage when choosing their insurance coverage and deductible options.

Navigating Hurricane Deductibles in Florida:

-

Policy Review: Consult your insurance agent or provider to review your policy and understand the specific terms and conditions related to hurricane deductibles.

-

Risk Assessment: Evaluate your property's vulnerability to hurricane damage, considering its location, construction, and proximity to coastal areas. This assessment will help you determine an appropriate hurricane deductible.

Partnering with Butler Insurance Group:

At Butler Insurance Group, we understand the unique challenges Florida property owners face when it comes to hurricanes. Our experienced team is here to assist you in navigating hurricane deductibles and ensuring you have the right coverage to protect your property.

In Conclusion:

Hurricane deductibles are a vital component of property insurance in Florida, given the state's exposure to hurricanes. By understanding how these deductibles work and assessing your property's risk, you can make informed decisions to safeguard your assets against the potential financial impact of hurricane-related damage. If you have questions or need assistance with your insurance policy, contact Butler Insurance Group today. We're here to help you navigate the complexities of insurance in the dynamic Florida landscape.